2024 Form 1040 Schedule 7 Little – Tax season — with its homeowner tax benefits — is one of the few times you may actually get some money out of your house instead of pouring money into it. Owning a house in the . You report commercial sales tax to the IRS on Schedule C, a supplemental sheet of the 1040 group of forms. Form 1040, Schedule C Use Schedule C to report all financial activity from your business. .

2024 Form 1040 Schedule 7 Little

Source : thecollegeinvestor.comChild tax credit expanded, business tax breaks get new life in

Source : iowacapitaldispatch.comHuman Development Center at LSU Health New Orleans | New Orleans LA

Source : www.facebook.comTax Season 2024: How to Create an Online IRS Account CNET

Source : www.cnet.com99 Bookkeeping Solutions, LLC

IRS Announces 2024 Tax Season Start Date, Filing Deadline | Money

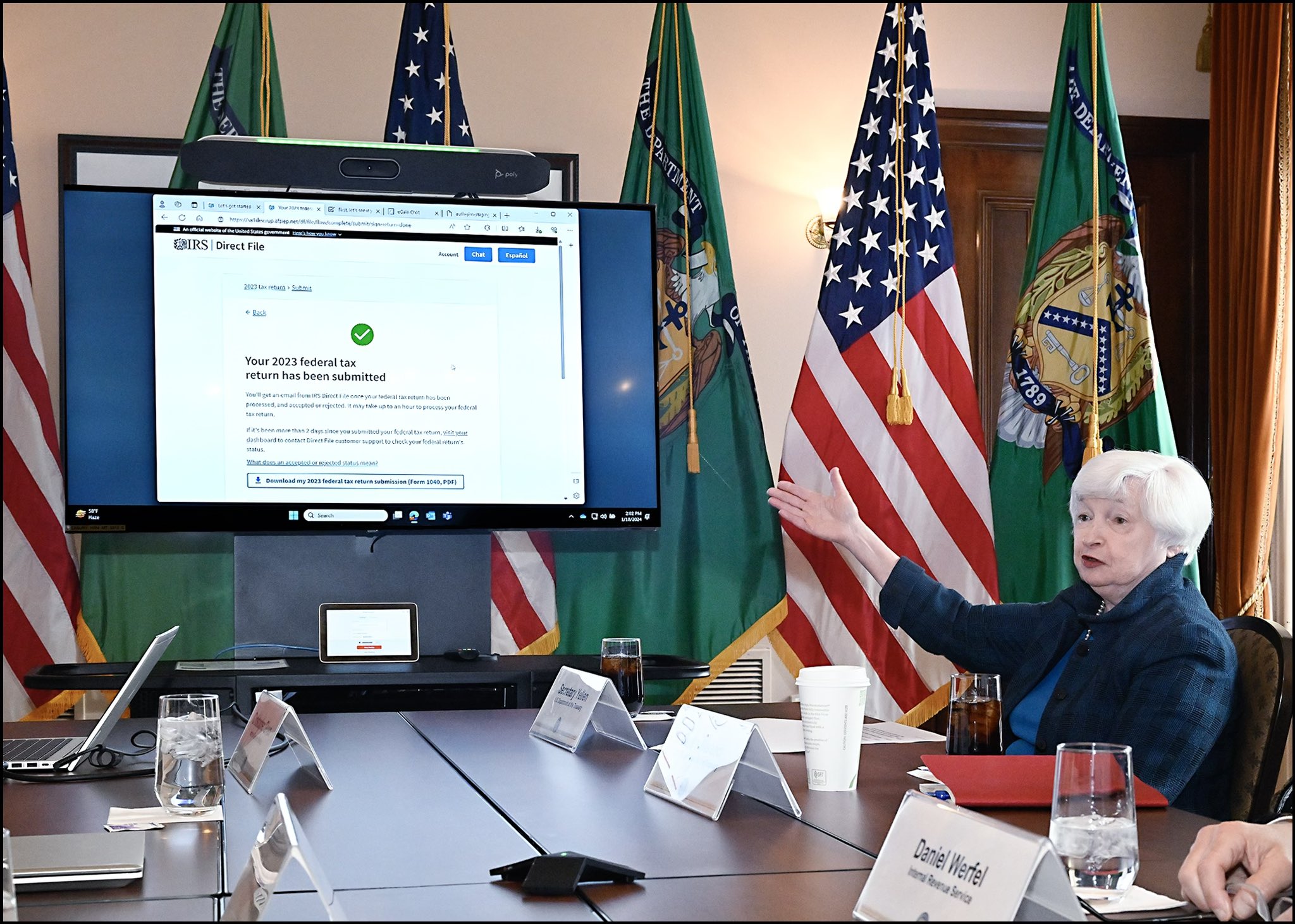

Source : money.comSecretary JaYellen on X: “I just received a demo of the

Source : twitter.comMaryland Society of Accounting & Tax Professionals, Inc. | Owings

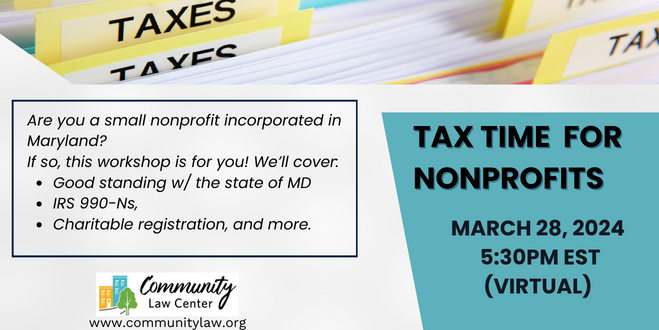

Source : www.facebook.comTax Time for Nonprofits | Community Law Center

Source : communitylaw.orgTax Breaks After 50 You Can’t Afford to Miss

Source : www.aarp.org2024 Form 1040 Schedule 7 Little When To Expect My Tax Refund? IRS Tax Refund Calendar 2024: Recent changes to Form 1040 mean different filing options for seniors. Get the facts about eligibility and reporting for this new version of Form 1040-SR. Recent changes to Form 1040 mean . To claim a loss from your small business, you must use Form 1040 as your individual income tax return form and Schedule C to demonstrate the loss. Complete “Part I” of Schedule C to determine .

]]>