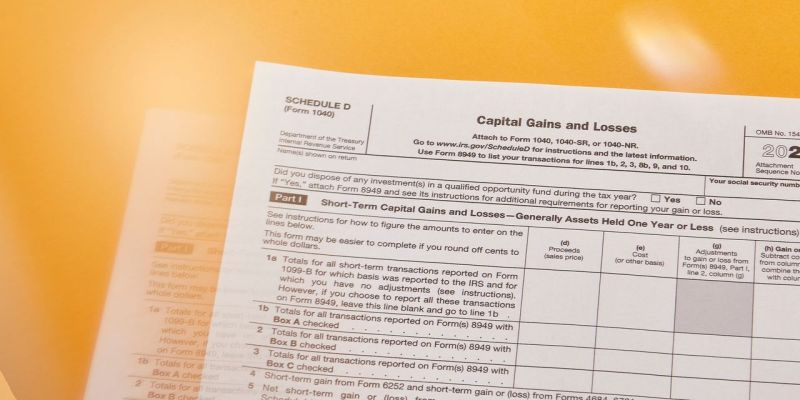

2024 Schedule D Instructions 1040 – the IRS writes in its Schedule D instructions. If your business sold a stock, bond or other investment asset, you will receive a 1099-B form with all of the information on the sale from each and . In 2011, however, the Internal Revenue Service created a new form, Form 8949, that some taxpayers will have to file along with their Schedule D and 1040 forms. Whenever you sell a capital asset .

2024 Schedule D Instructions 1040

Source : www.irs.govWhen Is Schedule D (Form 1040) Required?

Source : www.investopedia.comWhat the 2024 Capital Gains Tax Brackets Mean for Your Investments

Source : finance.yahoo.com1040 (2023) | Internal Revenue Service

Source : www.irs.govSchedule d tax worksheet: Fill out & sign online | DocHub

Source : www.dochub.comForm 1040 for IRS 2024 ~ What is it? Schedule A B C D Instructions

Paul D. Diaz, EA, MBA on LinkedIn: Congress hasn’t made changes to

Source : www.linkedin.comAll About Schedule A (Form 1040 or 1040 SR): Itemized Deductions

Source : www.investopedia.comSchedule D: How To Report Your Capital Gains (Or Losses) To The

Source : www.bankrate.comFiling taxes for your restricted stock, restricted stock units, or

Source : workplaceservices.fidelity.com2024 Schedule D Instructions 1040 1040 (2023) | Internal Revenue Service: The instructions for Form 8949 are included spaces at the top portion of Part I and Part II on Schedule D of Form 1040. Form 8949 provides directions at the bottom of the page. . The Internal Revenue Service (IRS) has announced updates to the Schedule 2 tax form and instructions for the upcoming tax years of 2023 and 2024. TRAVERSE CITY, MI, US, January 13, 2024 .

]]>

:max_bytes(150000):strip_icc()/2023ScheduleDForm1040-834ca4d0e21d479e90109c049215ae43.png)

:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)